Tough Housing Market Ahead

Inventory to rise, prices up 2.2%.

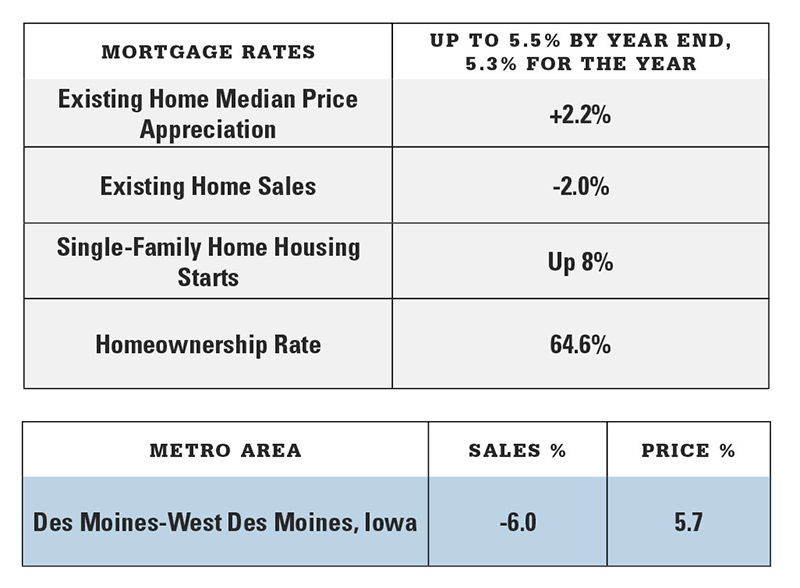

Rising rates and home prices will make it more difficult to buy or sell a home next year, according to realtor.com®‘s 2019 housing forecast.

According to the forecast, the 2019 housing market should see modest inventory gains, but with mortgage rates expected to hit 5.5% by the end of the year, monthly mortgage payments will rise 8%, putting home ownership more out of reach, especially for younger Gen-Z, Millennial and other first-time home buyers. Upscale homes in high-growth markets, however, will provide more opportunities for buyers.

Other findings of the realtor.com® 2019 housing forecast include:

- Home price growth will continue to slow, with a forecasted increase of 2.2%;

- Inventory increases will remain moderate with less than a 7% increase;

- High-priced markets will buck the trend, with double digit inventory gains;

- Millennials will account for 45% of mortgages in 2019 vs. 17% for Boomers;

- New tax plan will be good for renters, mixed for homeowners.

“Inventory will continue to increase next year, but unless there is a major shift in the economic trajectory, we don’t expect a buyer’s market on the horizon within the next five years,” said Danielle Hale, chief economist for realtor.com®.

“Unfortunately for buyers, it’s only going to get more costly to buy, especially the most-demanded entry level real estate. To be successful, buyers should think through how they’ll adapt to higher rates and prices.”

What will 2019 be like for sellers?

Although it remains a seller’s market, sellers will need to be mindful of their increasing competition and shouldn’t necessarily expect to name their price and get it in full—a change from the past few years. Above-median priced sellers, may find it will take longer to sell and require offering incentives, such as price cuts or other offerings.

With less demand in the market, there will be fewer bidding wars and multiple offers. However, with inventory expected to remain limited in most markets, sellers who price competitively can still walk away with a handsome amount of profit, but not the price jumps observed in previous years.

Key Housing Trends of 2019

- Modest inventory gains continue; high-end inventory growth spreads. Inventory hit the lowest level in recorded history last winter, but finally bottomed out and reached positive territory in October. National inventory increases will remain low in 2019 at less than 7%.

In the majority of markets, the number of homes being put on the market or newly constructed has increased slightly, while the pace of sales has slowed slightly, which has helped stop the inventory decline. But the inventory increases or slowing price increases necessary for a more widespread sales gain are not forecasted to happen in 2019.

While the situation is not getting worse for buyers, it’s also not improving notably in the majority of markets. High-priced markets are a different story. The majority of the inventory gains have been in upscale homes in high-growth markets, which suggests higher prices are incentivizing sellers.

Next year, realtor.com® forecasts more high-end inventory growth in major metros with the largest increases expected in: San Jose-Sunnyvale-Santa Clara, Calif.; Seattle-Tacoma- Bellevue, Wash.; Worcester, Mass.-Conn.; Boston-Cambridge-Newton, Mass.-N.H.; and Nashville-Davidson– Murfreesboro–Franklin, Tenn. all of which could see double digit gains in inventory in 2019.

- Soft home sales continue. After the best sales year in a decade in 2017, home sales are on track for a mild year-over-year decline in 2018, which is likely to extend into 2019 with a 2.0% decline.

Although long-term desire to own a home remains strong, especially among younger Gen-Z and millennials, the market challenges that make owning a home difficult continue to keep out first-time buyers, locking them out not only of their home, but also of the wealth by equity generation that owning provides them.

- Millennials purchase the most homes. Millennials will continue to make up the largest segment of buyers next year, accounting for 45% of mortgages, compared to 17% of Boomers, and 37% of Gen Xers. While first-time buyers will struggle next year, older millennial move-up buyers will have more options in the mid-to upper-tier price point and will make up the majority of millennials who close in 2019.

Looking forward, 2020 is expected to be the peak millennial home buying year with the largest cohort of millennials turning 30 years old. Millennials are also likely to make up the largest share of home buyers for the next decade as their housing needs adjust over time.

- Tax plan remains a wild card for housing. In April 2019, taxpayers will go through the income tax process for the first time since the new tax plan. For most renters, the results will be good: lower rates and a higher standard deduction should amount to lower tax bills.

- For homeowners, it’s a mixed bag. Some will benefit from lower rates and a higher standard deduction, but many others will find limited itemized deductions and personal exemptions mean a higher tax bill.

Despite the fact that 2017 home sales were the highest they’ve been in over a decade, sales in 2018 started to decline immediately following the tax plan.

While many factors influence home sales, it could be the case that without homeownership incentives some renters are holding off on buying. How the market will react in 2019 remains a wild card for housing.